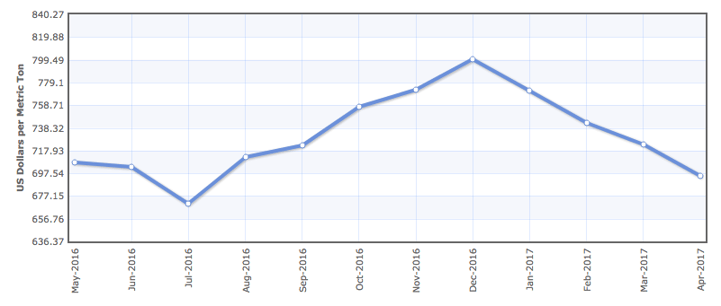

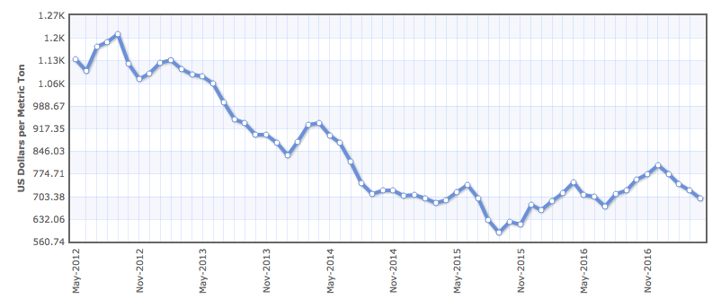

Staying on top of the CBOT market on a regular basis can be a daunting task for those that don’t have to do it as a daily part of their job.

As the soybean market changes, it affects the price of soybean oil, canola oil and other oils that are dependent on the soybean board. Fluctuations on a daily or weekly basis can make a significant impact on your bottom line.

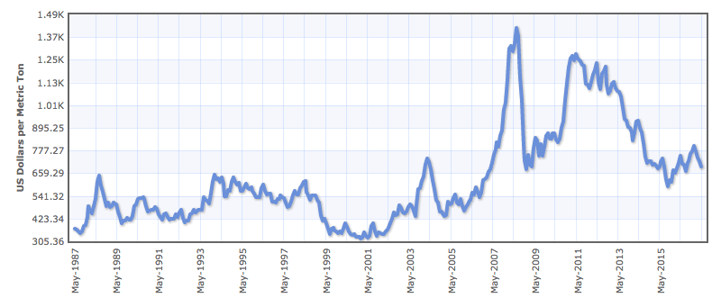

Having a bit of perspective as you’re tracking your prices as they go up or down can be very helpful. That’s what I’m providing today: a bit of perspective over time.

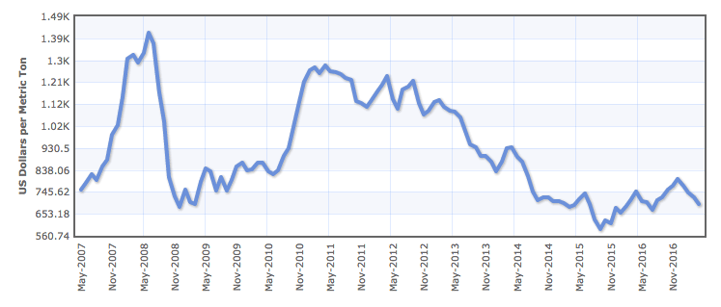

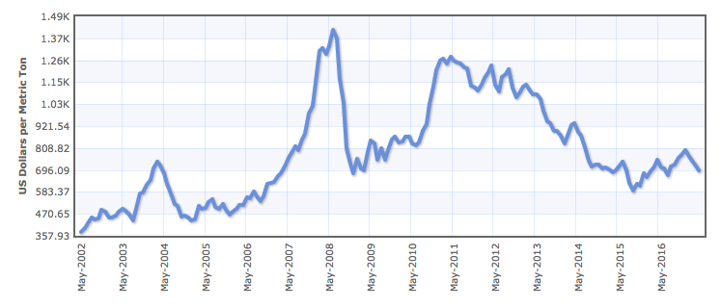

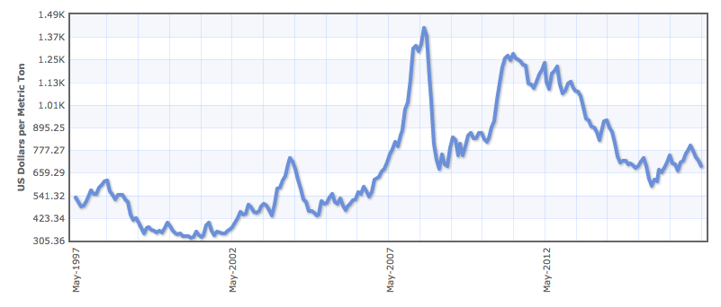

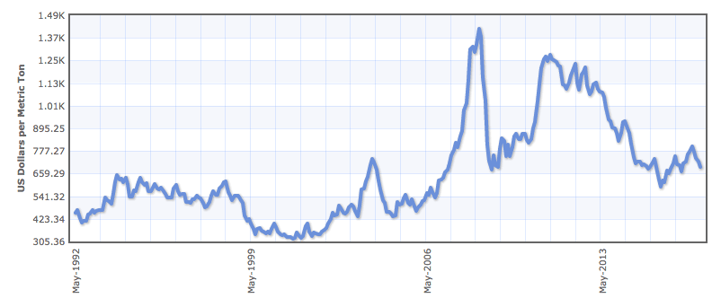

The following are graphs from the last year, 5 years, 10 years, 15 years, 20 years, 25 years and 30 years

(that’s quite a comparison timeframe!).

1 Year Market Overview

5 Year Market Overview

10 Year Market Overview

15 Year Market Overview

20 Year Market Overview

25 Year Market Overview

30 Year Market Overview

As you can glean from the charts above, the market has a lot of room to go up in comparison to the historical highs and lows, and it maintains a little room to go down. With the reasonably low market in comparison to the last 15+ years, many folks are opting to lock in contracts now instead of riding the spot market.

If you’re interested in locking in a contract, a common timeframe to do this for canola oil is in September and October, as the harvest is completed. Which means that now is the perfect time to get started! Centra Foods specializes in all non-GMO oil contracts, along with RBD Canola Oil contracts.

Topics: Harvest/Commodity Market