When it comes to the constant market fluctuations of bulk olive oil, global production (aka, how much olive oil is available in the world) plays a central part. However, there’s one more important thing to factor in: the strength of the euro.

The euro plays a key role in the olive oil market. This is because Spain, who is the “market driver” of olive oil prices uses euros as their currency. Because the world is using Spain’s market as a gauge for their own, this currency affects the olive market in particular. For buyers in the US, the euro to dollar conversion can become an important component of what prices look like — even if you specifically don’t buy in euros.

Because most olive oil is produced and imported from countries that use the euro as their currency, it becomes important to US buyers when the US dollar is weak in comparison. When the US dollar is weak (which it is right now), it means that the same one dollar isn’t going to go as far as it used to.

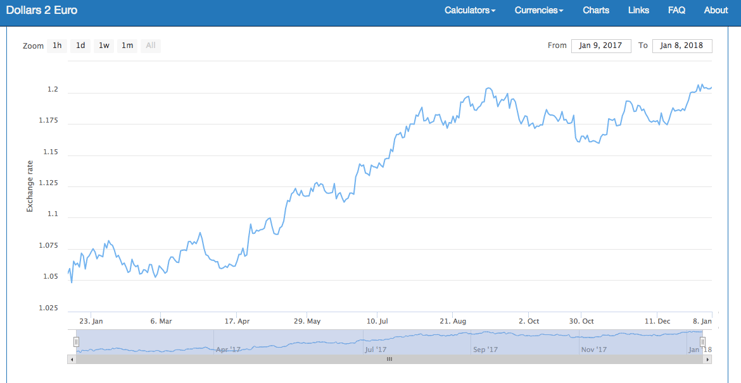

The chart below shows the increase in the dollar to euro comparison over the 2017 year. As you can see, the US dollar weakened, going from a low of 1.05 dollars to 1 euro to a high of 1.21 dollars to 1 euro just after the turn of the new year.

Of course, the commodity market for bulk olive oil has many other (often more important) factors that can play a part: if global production is up or down, if Spain’s production is up or down, what the surplus carry-over numbers look like and how much rain there has been in each region.

However, the euro does also play a part. In other words, the market price in 2018 is being affected by the global production first, and the euro second. But they are both playing a part on why the market price is what it is.

Olive oil commodity market comparisons and timing can be a complex thing. If you have any questions or want to learn more about the market, please reach out to us anytime.

Topics: Harvest/Commodity Market