The USDA recently released a report on oilseeds and production, which included a small feature on expectations of the upcoming 2017/2018 olive oil harvest.

Today, I'd like to go through their report, piece by piece, and add some commentary in that will be helpful to fully understand what they are saying and how it may affect your 2018 bulk olive oil buying plans.

USDA 2017/18 Olive Oil Harvest Expectations Report

[Author's Note: You will find my personal comments interjected in green italics throughout the USDA report shared below. I've bolded key factors to focus on in their report.]

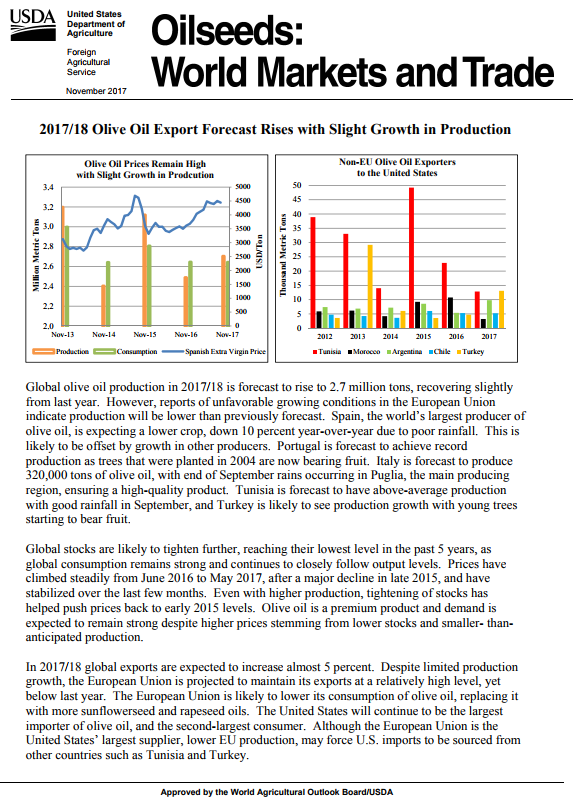

Global olive oil production in 2017/18 is forecast to rise to 2.7 million tons, recovering slightly from last year.

Global olive oil is expected to go up. Not by much, but it is expected to go up -- mostly because of Italy, Tunisia and Greece's expected increase in production. Tunisia's production is expected to be up 120%. Italy's production was down vastly the last few years due to a tree blight. This year looks like things are better for them, and their production is expected to go up by 60%. Given that they are the second largest producer in the world, this is a pretty sizeable increase in global volume available.

The good news is that they will put less pressure on the Spanish market. When Italy's production is low, they end up buying product (olives or finished oil) from Spain or Tunisia and shipping it out of their ports. Did you know that if olive oil sits in the ports in Italy for 72 hours, it becomes "product of Italy" by Italian law? That said, this Italian supply is often more costly than the surrounding areas and less fitting for the manufacturing/industrial supply sector, primarily due to demand in the retail and private label market for Italian products.

However, reports of unfavorable growing conditions in the European Union indicate production will be lower than previously forecast. Spain, the world’s largest producer of olive oil, is expecting a lower crop, down 14 percent year-over-year due to poor rainfall. This is somewhat offset by growth in other smaller producing countries.

Spain is the wild card in this situation. Their production is the largest in the world, usually making up about 50% of global production.

This means that they are the market "price driver". Aka, if their production drops and prices rise in Spain, olive oil prices rise everywhere. If their production increases and prices drop, most of the surrounding markets follow in suit to stay competitive.

So we've got two contracting factors at hand that could affect the market up or down: Spain's production is down (which would substantiate predictions that prices would go up) and there is less pressure on those markets from Tunisia, Greece and Italy (which could mean that prices could drop with less market pressure).

Portugal is forecast to achieve record production as trees that were planted in 2004 are now bearing fruit. Italy is forecast to produce 320,000 tons of olive oil, with end of September rains occurring in Puglia, the main producing region, ensuring a high- quality product.

Tunisia is forecast to have above-average production with good rainfall in September, and Turkey is likely to see production growth with young trees starting to bear fruit.

Global stocks are likely to tighten further, reaching their lowest level in the past 5 years, as global consumption remains strong and continues to closely follow output levels. Prices have climbed steadily from June 2016 to May 2017, after a major decline in late 2015, and have stabilized over the last few months. Even with higher production, tightening of stocks has helped push prices back to early 2015 levels.

Mills in many different countries -- but especially in Spain -- will "stockpile" extra olive oil in good harvests. This provides a buffer so that if the next year the harvest is late or lower than expected, they can still supply the necessary inventory in the next year.

These "stock levels" as they are called are tracked year to year. Needless to say, stock levels are getting increasingly low (at a 5 year low right now) and coupled with a poor harvest can make the market react more strongly if the next harvest's supply is unavailable. It can also apply more market pressure driving the price up in itself.

Olive oil is a premium product and demand is expected to remain strong despite higher prices stemming from lower stocks and smaller- than- anticipated production. In 2017/18 global exports are expected to increase almost 5 percent.

Despite limited production growth, the European Union is projected to maintain its exports at a relatively high level, yet below last year. The European Union is likely to lower its consumption of olive oil, replacing it with more sunflower seed and canola oils.

Much of Europe will actually consume less olive oil if prices increase during a poor harvest year. This helps ease some of the pressure on the market, but not necessarily a whole lot.

The United States will continue to be the largest importer of olive oil, and the second-largest consumer. Although the European Union is the United States’ largest supplier, lower EU production, may force U.S. imports to be sourced from other countries such as Tunisia and Turkey.

The US has steady demand for olive oil, and we don't expect that to drop anytime soon. Expect more products imported from "supporting" EU countries like Turkey and Tunisia this next year, given that Spanish production is expected to be lower across the board.

The Wild Card: The Euro to Dollar Exchange Rate

Aside from all of the harvest results, there is also the part that the euro to dollar exchange rate plays. Comparing this time last year to this time this year, the exchange rate has jumped substantially and only has continued to rise. This has been a big factor with the total pricing for olive oil, given that Spain -- the driver for prices in the market -- runs off the strength of the euro.

Overall Personal Predictions

With these opposing factors happening in the global olive oil market, I think that chances are pretty likely that the market will stay reasonably steady (all other factors aside, looking only at the production side of things). I do expect that it will also increase gradually through the spring.

Keep in mind that the Euro to US Dollar also plays a part in this. The euro strengthened over the 2017 year dropping ever-so-slightly only recently, which put additional pressure on the already increased market this last year. Where the euro goes in 2018 will definitely play a part in the overall market and pricing levels.

Update: As of January 2018, the euro is playing a large part in where the market stands, and is up from last year due to this factor. If the euro to dollar exchange rate drops significantly, the prices of olive oil will likely follow in suite. However, if it goes up the market will also likely go up.

Topics: Harvest/Commodity Market